More long-term contracts

These factors lead to more long-term contracts for vessel operators. However, inflation and cost developments also challenge investment projects, making right-sizing and flexibility crucial strategies.

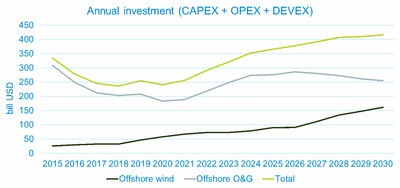

The offshore vessel market benefits from the increasing CAPEX (capital cost) spending in the oil and gas (O&G) and renewables sectors. The offshore O&G sector will reach its peak investment in 2026, with nearly $300 billion. After that, the offshore energy investment will shift towards offshore wind. The total investment in offshore energies will exceed $400 billion in 2028, almost double the amount in 2020.

This has impacted the chartering market, seeing significantly more long-term contracts, where O&G competes with offshore wind to secure tonnage for the future, indicating that charterers are strategically positioning themselves to secure the availability of operating assets needed to carry out projects in the years ahead. In the last months, it has become apparent that most of the medium to large subsea vessels have been chartered for 3+ years by EPC contractors to secure this tonnage.

One fleet, two energy markets

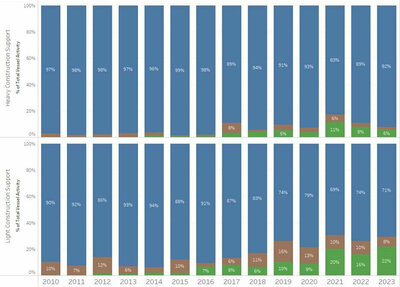

The subsea vessels, originally built for offshore O&G operations, have become an integral part of the value chain in the offshore wind market. The smaller subsea vessels – light construction support vessels with cranes between 25 and 150 tonnes – depend largely on the activity in the offshore wind and other markets (such as other renewables, defence, etc). By 2023, 30% of their activity was outside the offshore O&G market. The larger subsea vessels – heavy construction support vessels with cranes between 200 and 400 tonnes – are more reliant on the O&G market, with less than 10% of their activity outside it.

Right-sizing

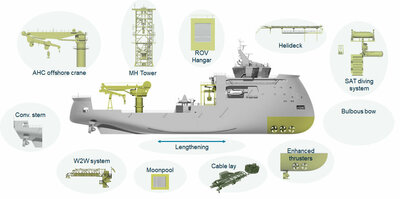

Flexibility is important in multi-energy market opportunities, and right-sizing means choosing the optimal vessel size and capabilities for each project, avoiding unnecessary costs and inefficiencies.

Flexibility needed to maximise fleet utilization

Although the offshore vessel market is growing fast, it also faces some challenges. Inflation and cost developments make it harder to finance and justify new builds. Right-sizing is essential to avoid wasting money on oversized vessels. Every dollar counts in today’s market. Vessels also need to be flexible to ensure high utilization. They need to serve multiple markets and perform diverse activities.

Flexibility in design is a smart way to deal with future market uncertainty. It allows vessels to operate in different markets and adjust their topside equipment according to the needs of each contract.

Ulstein has a long history of designing vessels that meet market demands. We design to meet the required capacities and capabilities and ensure that the vessel becomes an efficient platform and tool, balancing performance and cost. Flexibility is met by integrating required equipment and preparing for future upgrades, such as cranes, towers, ROVs, gangways, and other features. Together with our clients, we configure the optimum combination of functions.

Customizing the power solution to match the vessel’s operational modes ensures minimal fuel consumption and emissions, leading to reduced OPEX. Additionally, incorporating future remote maintenance and support capabilities from shore is among the potential enhancements.

Preparedness is a key strategy for coping with changing regulations and new technologies. Our goal is to reduce the vessels' energy demand and prepare them for alternative fuels.