The Offshore O&G (OO&G) market is experiencing a new spring, with oil prices fluctuating between 70 and 80 USD per barrel. The oil crisis in 2014 prompted the market to focus on cost reduction and enhancing operational efficiency across the entire value chain. Such cost reductions have resulted in strong cash flows in the current market, which, combined with the need for additional energy, are driving new investments. This resurgence in the OO&G market also presents an opportunity to re-focus and establish a foundation for more environmentally friendly activities.

New upstream investment activities have increased demand for vessel services, particularly among subsea tonnage. The platform supply vessel (PSV) market has also seen rising demand, narrowing the gap between the existing fleet and the need for services. Consequently, the first vessel newbuilding contracts have started to materialise, with over a dozen PSVs and subsea vessels ordered in 2024.

However, the OO&G sector is not the only one driving demand for this tonnage. The growing offshore wind market is also chartering a significant portion of subsea vessels, especially those with walk-to-work functionality or cable-laying capabilities.

Further newbuilding needed to cover growing demand

Higher investments in the offshore energy market will continue to drive demand for subsea services. However, part of the existing fleet might become uncompetitive and exit the market. Extended lay-up periods, high energy consumption, and obsolete technologies could lead owners to recycle subsea vessels that are 30 to 40 years old.

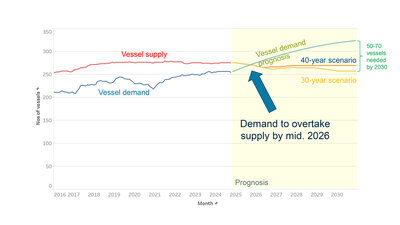

In this scenario, the balance of supply and demand might resemble the prognosis shown in the enclosed figure. Demand could surpass supply by 2026, even with the new buildings currently on order. By 2030, an additional fleet of 50 to 70 subsea vessels may be required to cover the energy market's demands.

Segment variations

However, not all vessel segments and regions are recovering at the same pace. While the subsea market in Northern Europe is enjoying healthy day rates, the platform supply market experienced a relatively slow summer.

Newbuilding prices in a new league

Day rates have recovered in many segments to pre-2014 levels, but this does not mean the return on investment (ROI) is as high as in 2014. With new building prices having risen by 50% since 2014, the importance of selecting the right ship design and shipyard for new building projects has increased significantly.

Price and delivery time

Balancing price and delivery time is essential in a market where timing is crucial. Our flexibility in choosing shipbuilding locations is a significant advantage. In addition to our yard in Norway, we have a network of partner yards worldwide. Whether you prefer to build in Asia, Europe, or elsewhere, our global presence ensures you can select the most suitable yard for your project. This flexibility helps manage costs and optimise delivery times.