Although offshore wind is a booming industry, with margins under pressure it also is a very challenging market. And the latter applies to the decom market as well. Ulstein market analysis shows that current demand projections reveal a shortage of heavy lift vessels through the 2020s.

Based on years of successfully designing heavy lift vessels, Ulstein has developed a strategic business case for a new heavy lift vessel taking into account the characteristics of both markets in 2030.

Offshore wind market

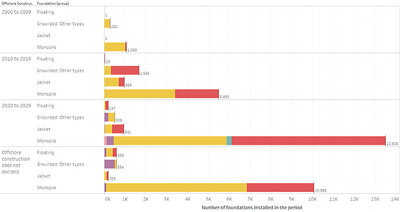

In the renewables sector, offshore wind turbines are getting larger as are (the number of) wind farms worldwide. With monopiles being by far the industries' favourite turbine foundation for the years to come, it was identified that upto 2030 at least 13,500 monopile installations will have to be installed (mostly in Europe and Asia). In addition, more than 10,000 monopile installations are in planning stages, with the date yet to be decided.

These monopiles are expected to increase in size and weight upto a maximum feasible 2,500-3,000 tonnes by the end of the decade.

Taking certain time assumptions for transporting and installing monopiles, a 70% utilisation rate on the installation vessel and the confirmed monopile installation till 2030, we identified that at least 10 heavy lift vessels will be needed full time until 2030.

Decommissioning market

Looking at the decommissioning market, Ulstein has worked together with The Offshore Partners (TOP) on mapping the potential. The North Sea and Gulf of Mexico have been clearly earmarked as the hotspots, where over 2,000 projects are planned for decommissioning of installations in water depths less than 60 m and topside weights less than 2,000 tonnes.

On top of this, South East Asia, Arabian Gulf, Latin America and West Africa are considered as emerging and future hotspots, but have not been taken into account yet for the current business case.

Based on the above and again taking certain assumptions for platform removal and 70% vessel utilisation rate, the decom market in the North Sea and Gulf of Mexico alone is expected to keep five heavy lift vessels in business full-time for next 20 years.

Installation methodologies and heavy lift vessel supply

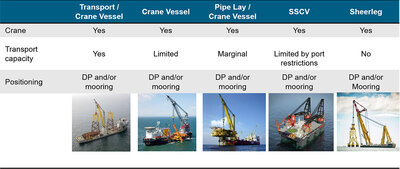

In the study conducted, Ulstein defined 2 main installation methodologies:

1. The feeder concept, where the cargo to be installed is transported (mostly) by barge to the heavy lift vessel. A method, which is very suitable for individual, engineered platform lifts

2. The Transport & Installation (T&I) concept, where the heavy lift vessel is also transporting the cargo on its own deck to the installation side. This method is optimal for industrialised, multiple lifts, like foundation installation in offshore wind.

From the above, the T&I concept with a dedicated transport/crane vessel is believed the most cost effective solution for the business case.

From the above it is concluded that the vast majority of lifts in both markets will be below 3,000 t in weight. Our research also shows a total of around 50 heavy lift units with lifting capacity above 2,000 tonnes available worldwide by 2022. However, only 5 of these are considered competitive transport/crane vessels.

Strategic fit

Given the data, it is clear there will be a shortage of vessels in the market over the next decades. Of course, some of the shortage can be resolved by converting existing vessels. Besides technical challenges, this is not considered to be the best strategic fit for future markets.

The question now is, what to invest in?

Based on the market analysis, Ulstein has defined the specifications for a newbuilding, 3,000 tonnes heavy lift vessel design capable to transport and install either six 2,000 tonne monopiles or five 1,500 tonne jackets. The result is the ULSTEIN HX118 design, a 193.2 m long vessel with a large, flush deck and a main crane able to lift 3,000 tonnes at 30 m and 2,000 tonnes at 40 m radius.

ULSTEIN HX118

And for those that are tempted to go for a 5,000-tonne crane, the design is capable to handle such a crane. However, if you have a vessel that already covers 80% of the targeted market, what is the driver to justify the significant additional investment on a 5,000 tonne crane?

Interested in our analysis? Please contact us, as we like to learn your vision and discuss potential solutions.

If you are curious to see the key features of the HX118 design, please look at our web page here, or request a data sheet.